- #Mortgage calculator extra payment principal plus#

- #Mortgage calculator extra payment principal download#

It’s designed to provide you with quick and convenient estimates related to loan amounts, interest rates, monthly payments, amortization schedules, and other relevant factors. Our useful mortgage loan and tax calculator is a tool that helps borrowers across Wisconsin and Illinois estimate various aspects of a loan. Treasury Management Receivable Solutions.Dental & Health Care Practice Financing.Health Savings Accounts | Online Enrollment.Digital Wallets: Your Device, Your Choice!.If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase.

#Mortgage calculator extra payment principal download#

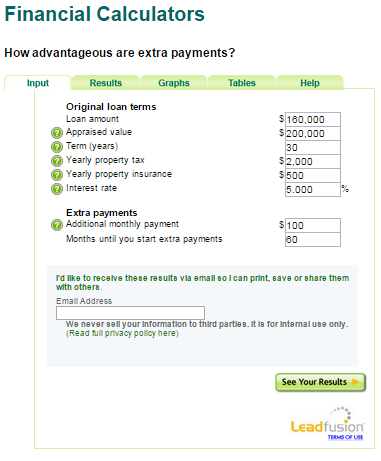

You can get a free online extra payment calculator for your website and you don't even have to download the extra payment calculator - you can just copy and paste! The extra payment calculator exactly as you see it above is 100% free for you to use. Add a Free Extra Payment Calculator Widget to Your Site! Let's be honest - sometimes the best extra payment calculator is the one that is easy to use and doesn't require us to even know what the extra payment formula is in the first place! But if you want to know the exact formula for calculating extra payment then please check out the "Formula" box above.

If you start making extra payments after the loan inception date, the figure may be different.

#Mortgage calculator extra payment principal plus#

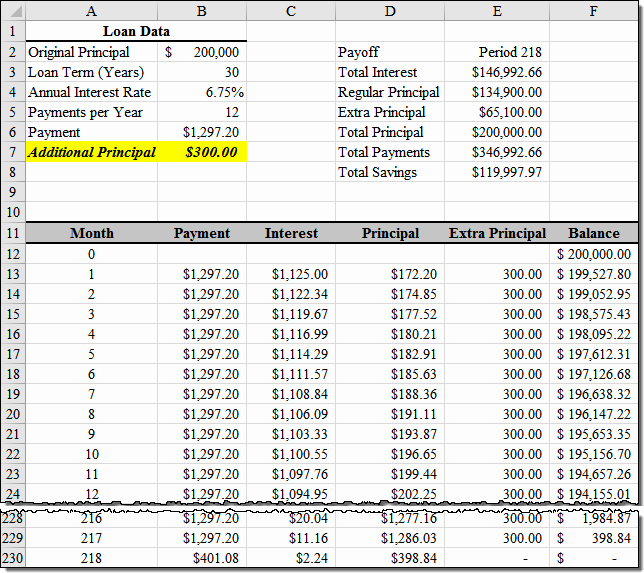

With extra payment – The total cost of loan plus interest if extra payments are made.Original total cost – The total cost of the loan plus interest if no extra payments were made.The calculator will use all of the date you have entered and will display the following information for you to review: Extra payment per month (how much you plan to pay extra on a monthly basis)Īfter you enter all of the figures, simply press calculate.Annual Interest Rate (the fixed APR charged to borrow).Years to payoff (term of the loan stated on the contract).Loan amount (total principal of the loan stated on the contract).The extra payment calculator allows you to enter the following figures: You can see the savings for yourself by inputting all of the correct information in the fields above and pressing calculate. Even just an extra payment of $20 per month can make a huge different over a 30 year term. By using an advanced calculator, you can see the savings in a matter of seconds and persuade yourself to bite the bullet and pay more every time you receive your car or mortgage loan statement. Find Out How Much You Can Save With This Calculatorĭetermining how much you can save in interest when you make extra payments can be extremely difficult if you attempt to do this by hand. The savings can add up over time and total in the thousands depending on the amount borrowed, the interest rate of the loan, and the term.

Why Make Extra Payments?īy making extra payments on your loan, you can pay down the principal and reduce interest charges each and every month.

Unfortunately, this loan disclosure does not show the borrower what they can save in interest if they make extra payments each month to pay down the principal of the loan. When you are approved for a loan, the disclosure describes exactly how much interest you will pay over the life of the loan if you make all of your payments on time and you pay only the amount due. Use our free Extra Payment Calculator to find out just how much money you are saving in interest by making extra payments on your auto, home, or other installment loans.

0 kommentar(er)

0 kommentar(er)