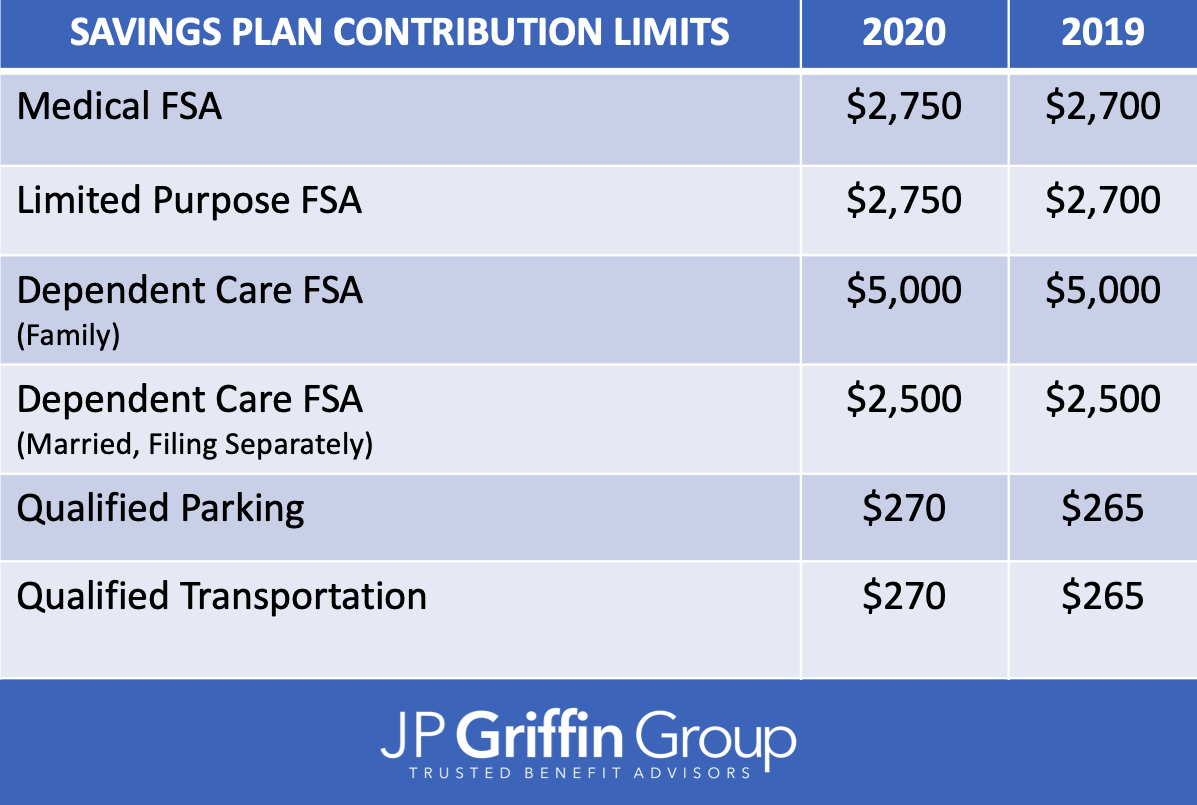

Plan carefully! IRS rules require you to forfeit any balance left in your FSAs at the end of the year - the “use it or lose it” rule. Limited Purpose FSA Those enrolled in the Consumer Choice HSA healthcare plan can contribute up to $ 2,750 annually to a Limited Purpose FSA, which can be used for eligible dental and vision expenses only. You can contribute up to $5,000 a year or $ 2,500 if you’re married and file separate income tax returns. Examples of Limited Purpose FSA Eligible Expenses. Qualified expenses include eye exams, eyeglasses, contacts, regular dental checkups, fillings. If you don’t spend down your money by a specified date during a. Like standard FSAs, that amount is subject to an annual IRS limit. If you have a health plan through an employer, a flexible spending account (FSA) is a tool offered by many employers as part of their overall benefits package. This means that you can contribute the max 2,750 in 2021 or 2,850 in 2022. Employer contributions to a LPFSA are not included in your annual limit. An FSA is a use it or lose it type of benefit. The IRS FSA contribution limit changes every year. Important Reminder: FSAs, HRAs and other account types listed may not all be the same. These include daycare expenses and summer camps for children under age 13 and care for an elderly parent. FSAs are regulated by the IRS, who determines what expenses are eligible. In 2021, the FSA contribution level maximum is 2,750, according to the IRS. From A to Z, items and services deemed eligible for tax-free spending with your Flexible Spending Account (FSA), Health Savings Account (HSA), Health Reimbursement Arrangement (HRA) and more will be here, complete with details and requirements. You can contribute up to $2,750 a year.ĭependent Care FSA A Dependent Care FSA can help you pay dependent care expenses. Healthcare FSA If you don’t have access to an HSA, you’re eligible to have a Healthcare FSA to cover healthcare, prescription drug, dental and vision expenses. Contributions to an Optum Flexible Spending Account (FSA) for healthcare and dependent care expenses are tax-free, allowing you to save money on your federal and state income taxes and Social Security taxes.

0 kommentar(er)

0 kommentar(er)